One of BAAC’s risk management strategies approaches is beginning with organizing the structure of risk management cluster.

by Surasak Sompadong, Assistant Director, Office of Customer Products and Marketing Development Department, Bank of Agriculture and Agricultural Cooperatives, Thailand

(Paper presented during the Regional Training Course on Value Chain Finance in Agriculture at SD AVENUE Hotel, Bangkok, Thailand July 15-19, 2013)

INTRODUCTION

How BAAC handle customer’s risk?

As it has been obviously perceived that agricultural produce has been playing a significant role for Thailand’s economy. Additionally national security relies on the security of farmers’ standard of living. Consequently, the quest for means of protecting farmers’ income has been set on the Bank for Agriculture and Agricultural Cooperatives (BAAC)’ s agenda which gives top priority to this particular issues on which country’s sustainable development is based on.

Stating in BAAC vision, BAAC aims at promoting a sustainable livelihoods for client farmers. Therefore, BAAC, collaboration with government and others agencies such as Thai insurance companies, the World Bank, GIZ, FAO, APRACA and most importantly IFAD have initiated various strategies and tools to cope up with RISK. BAAC risk management practices are increasingly important. Her risk management operation is for not only her organization but also link to farmer clients as well.

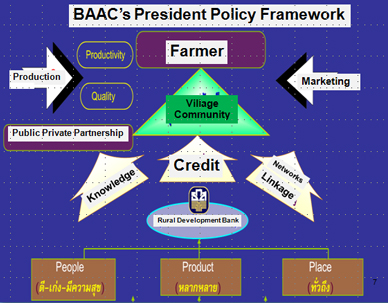

As a financial institution and its’ readiness to move forward to play the roles of Rural Development Bank which will focus on strengthen rural sector of the country, BAAC is aware of the importance of efficient risk management to respond to stakeholders including the Ministry of Finance, agricultural cooperatives, depositors and farmer clients. The banking businesses always confront risk arising from customers, natural disaster, economic changes, competition, technology, regulations and work process. BAAC must control risk to be under acceptable level. The objectives of risk management are focusing on firstly reduce or control damages affecting the operation arising from uncertainty event or unexpected event. Secondly, BAAC’s operation has to be in line with good governance.

One of BAAC’s risk management strategies approaches is beginning with organizing the structure of risk management cluster. In BAAC case, we establish the Risk Management Department to responsible for preparing policy framework, implementing according to the plans and monitoring and set up of the overall scope of the organization. This framework has to submit to the Board of Director for approval, whilst the Audit Committee is responsible for the audit of effectiveness and sufficiency of risk management process of the organization and various hosts to set up risk management policy and practices in their own responsibility in line with the bank’s policy. Every workplace handles its own risk evaluation and control self-appraisal. The Audit Department is responsible for the review of every unit’s operation and appraises the sufficiency of the bank’s risk management system.

Leave a Comment

You must be logged in to post a comment.